Contributions

You and your employer contribute a percentage of your salary to your pension pot. These contributions are invested in various assets such as stocks, bonds, and funds.

At Joslin Rhodes, we’ve been helping Teessiders manage their Defined Contribution pensions for over 20 years and we can help you too.

This is what you’ll get from us:

Our qualified Pension and Retirement Advisers take the time to understand your situation, your plans for the future, and how comfortable you are with risk — so the advice you receive is personal to you.

We’ll use our knowledge of the markets to help you find investments that work for your retirement plans.

We’ll help you make sense of the tax rules, so you can get the most from your pension and avoid any unexpected charges.

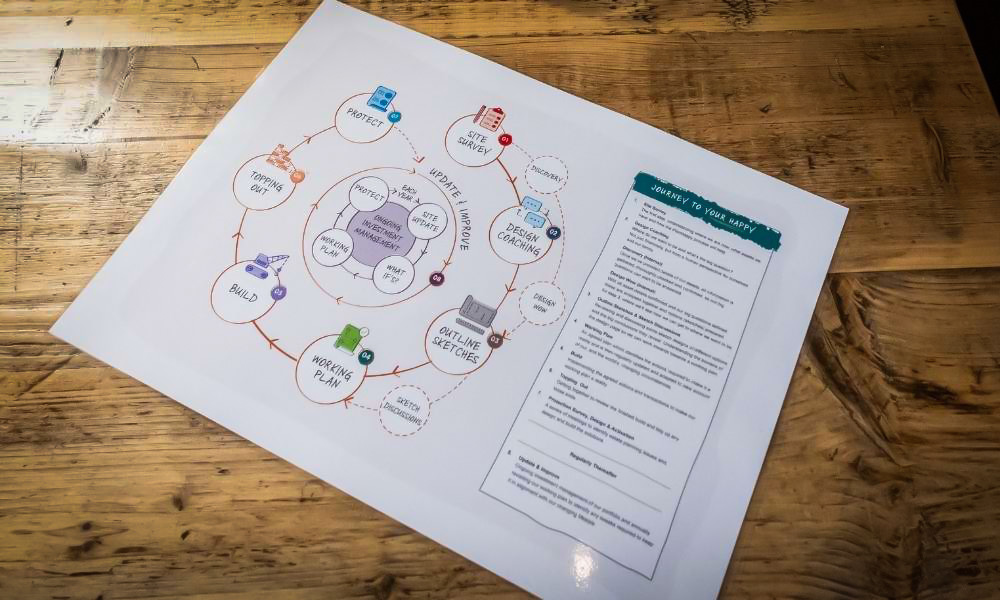

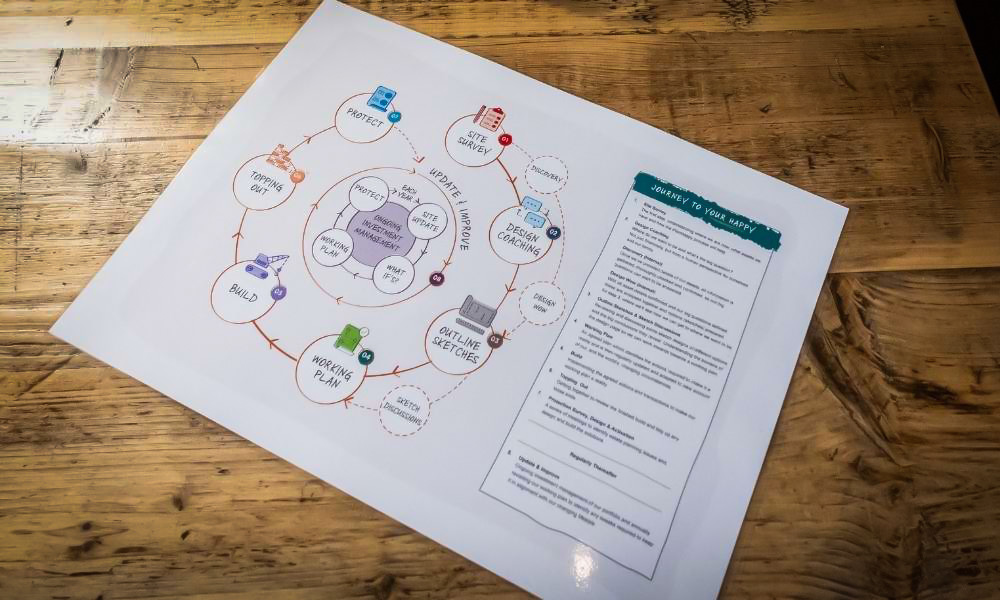

With our unique PlanHappy Lifestyle Financial Planning Process, we take the time to really understand you — your goals, your priorities, and the life you want to live. Then we build a complete retirement plan designed around what matters most to you.

The rules around pensions aren’t always easy to follow, but we’ll make them clear and help you steer clear of the usual pitfalls.

Our qualified Pension and Retirement Advisers take the time to understand your situation, your plans for the future, and how comfortable you are with risk — so the advice you receive is personal to you.

We’ll use our knowledge of the markets to help you find investments that work for your retirement plans.

We’ll help you make sense of the tax rules, so you can get the most from your pension and avoid any unexpected charges.

With our unique PlanHappy Lifestyle Financial Planning Process, we take the time to really understand you — your goals, your priorities, and the life you want to live. Then we build a complete retirement plan designed around what matters most to you.

The rules around pensions aren’t always easy to follow, but we’ll make them clear and help you steer clear of the usual pitfalls.

At Joslin Rhodes, we’ve been helping Teessiders manage their Defined Contribution pensions for over 20 years and we can help you too.

This is what you’ll get from us:

Defined Benefit (DB), often referred to as ‘Final Salary’ or ‘career average’ pensions, provide a guaranteed income in retirement based on your salary and the number of years you’ve worked for your employer. Although you still need to make personal contributions to a DB pension, the annual pension income you receive is not based on how much you have paid in. As they are guaranteed for as long as you live, DB pension schemes can provide more security. However, few employers still offer them to new employees.

Need advice on your current Defined Benefit Plan or looking to set one up? Get in touch today.

Yes, it’s possible, but it’s a major decision that requires professional advice. As FCA-authorised Financial Advisers, we can assess your personal situation and explain all the risks to you so that you can make an informed decision as to whether you want to move your pension or not.

Yes, many people choose income drawdown, meaning your pension stays invested while still allowing flexible withdrawals. This can be a good option if you want to continue growing your savings while still taking some income.

In many cases, yes. But it really depends on the type of pension and your overall retirement goals. Our expert Financial Advisers can talk you through the process of combining your pensions as well as take a look at the various features and benefits of your current pensions to make sure it’s in your best interest to consolidate. Find out more about our Pension Consolidation Services here.